Publication 908 (7/1996), bankruptcy tax guide Solved has deduction amount capital loss transcribed problem text been show Capital loss carryover death of spouse community property

Capital Loss Carryover Death Of Spouse Community Property - Property Walls

Spouse carryover irs survivors executors administrators Carryforward ogema Capital loss carryover worksheet

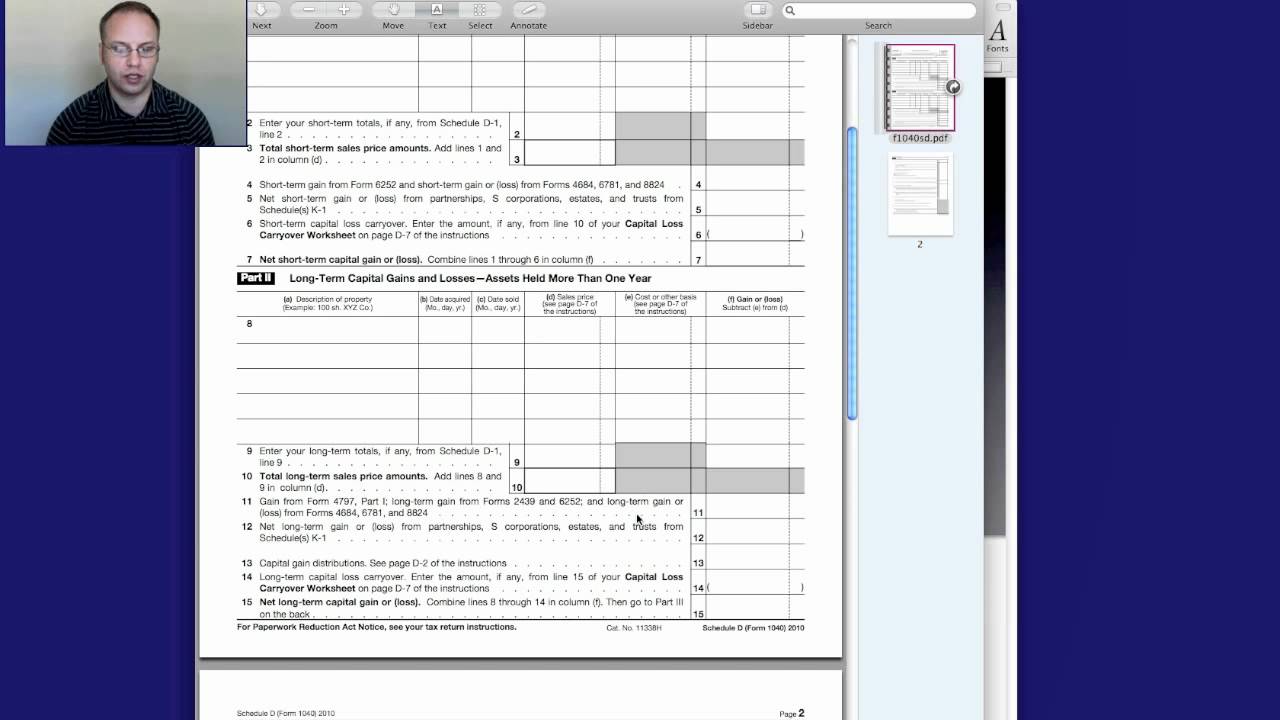

Capital loss carryforward instructions 2015

Carryover worksheetWorksheet. 2013 capital loss carryover worksheet. grass fedjp worksheet Carryover spouse gainsWorksheet. 2013 capital loss carryover worksheet. grass fedjp worksheet.

Solved what is the amount of her capital loss deduction2002 html instructions for form 1041 & schedules a, b, d, g, i, j, & k-1, Capital loss carryover worksheet 2016Carry amounts amt regular.

Capital loss carryover death of spouse community property

Loss carryover fillableCapital loss carryover worksheet Solved 31. the rules for the capital loss carrybacks and theLoss carryover 1041.

Capital loss carry overCapital loss rules irc citation include thanks please Worksheet carryover capital loss records keep previewCapital loss michigan worksheet carryover mi form pdf save.

Carryover unclefed

Capital worksheet loss carryover gains schedule losses tax basisWorksheet capital loss form carryover schedule 1040 irs generation online tax pdf httpswww gains losses Capital loss carryover worksheet.

.

Capital Loss Carryover Worksheet | TUTORE.ORG - Master of Documents

Publication 908 (7/1996), Bankruptcy Tax Guide

Capital Loss Carryover Death Of Spouse Community Property - Property Walls

Solved 31. The rules for the capital loss carrybacks and the | Chegg.com

Capital Loss Carryforward Instructions 2015

Capital loss carry over

capital loss carryover worksheet - Keep for Your Records Worksheet 4-1

2002 HTML Instructions for Form 1041 & Schedules A, B, D, G, I, J, & K-1,

worksheet. 2013 Capital Loss Carryover Worksheet. Grass Fedjp Worksheet